Tracking interest rates over time shows us significant volatility over long-enough time periods. Typically, the rates will be lowest on mortgages, highest on credit cards, and somewhere in the middle on auto loans. We can predict only one thing about interest rates with reasonable surety: that rates will change significantly over most 10-year periods.

Key Takeaways

- Mortgage rates have fluctuated from an all-time record high of 18.45% in 1981 to a record low of 2.65% in 2021, before rising to a 23-year high of 8.01% in October 2023. As of Q2 2024 30-year fixed rates stood at 6.95%

- Credit card interest rates have fluctuated over the past decade from a record-low 12.74% in 2014 to a record-high 22.76% in Q2 2024, and are unlikely to fall until the Fed begins to lower the discount rate later in 2024.

- Auto loan interest rates for all credit scores for new car loans (at 48-month terms) have gone from a high of 17.36% in 1981 to a low of 4.00% in 2015, and as of May 2024, they were 8.65%.

Interest Rate Trends and Variance

Typically, the rates on mortgages will be the lowest, the rates on credit cards will be the highest, and the rates on auto loans will be somewhere in the middle.

Mortgage Rates

Tracking interest rates over the last 51 years with data provided by Freddie Mac shows that the ten years from 2012 to 2022 had had the consistently lowest rates, with every single monthly average during that time remaining under 5% interest on a 30-year fixed-rate mortgage.

While rates steadily climbed from their record-breaking average low of 2.65% in January 2021 and rapidly increased in 2023, 30-year fixed mortgage rates are still not as high as in some periods compared to past decades. From 1971 to 2002, rates never dropped below 6% interest and fluctuated from 6.05% to a record high of 18.45% in October 1981. Rates maintained a yearly average above 10% for the entire period from 1979 to 1990.

Following the highest inflation in 40 years in 2023, rates shot up and peaked in October of last year at 8.01%, a 23-year high. As of Q2, 2024, the average mortgage interest rate was 6.95%, with a 52-week average of 6.6% to 7.79%.

Credit Card Interest Rates

Credit card interest rates have fluctuated much less than mortgage rates since 1994, when the Federal Reserve began tracking data. Rates have fluctuated from a low of 11.96% in the first quarter (Q1) of 2003 to a high of 22.76% in Q2 2024.

Credit card interest rates are unlikely to fall significantly over the coming years, as credit balances are at an all-time high in spite of high interest rates. Unlike mortgage rates, the government doesn’t have any programs to entice lenders to offer lower interest rates. Most card rates are indexed to the prime rate; however, if that drops significantly, then rates could trend downward.

Auto Loan Interest Rates

Auto loan interest rates have fluctuated more than credit card interest rates but less than mortgage rates. Data goes back to 1972 on traditional 48-month new car loan interest rates. They have fluctuated from an all-time high of 17.36% in late 1981 to an all-time low of 4.00% in late 2015. Interest rates remained in the 4.00%–5.50% range from 2012 through most of 2022, but they’ve risen since then. As of May 2024, the average 48-month new car loan was 8.65%.

However, according to 2024 research, the average new car loan term length is more than that—about 68 months. The Federal Reserve began tracking 72-month new car loan interest rates in 2015 but began tracking 60-month loans much earlier, in mid-2006. For the first two years of tracking, 60-month new car loan interest rates were steady between 7.18% and 7.82%, until the rate dropped below 7% in Q2 2008. 60-month interest rates were below 6% from Q2 2011 till Q4 2022. However, rates have risen significantly since then; in Q2 2024, the average 60-month new car loan interest rate was 8.20%.

72-month new car loan interest rates were under 6% from 2015 (when the Federal Reserve began tracking it) through Q3 2022, with the highest peak at 5.63% in Q4 2018. The lowest rate during that time was 4.08% for two consecutive quarters in 2016. But once again, rates have risen since then: As of Q2 2024, the average 72-month new car loan interest rate was up to 8.32%.

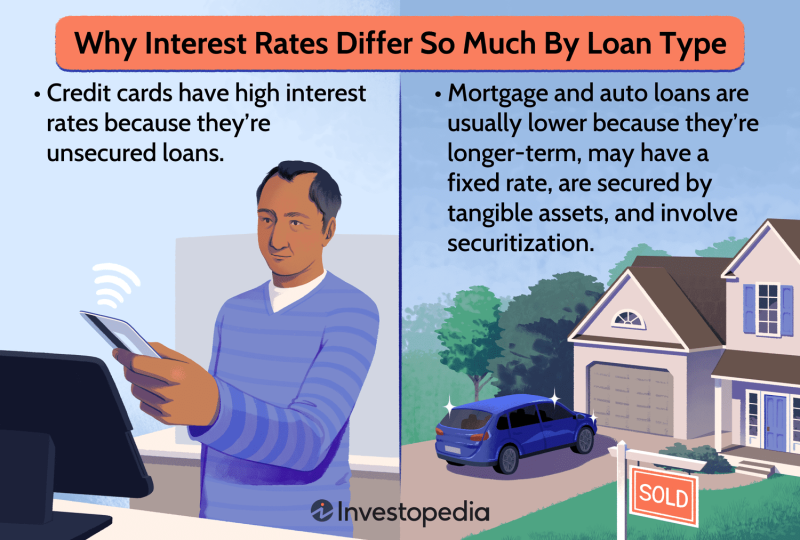

Why Interest Rates Differ So Much by Loan Type

Credit cards traditionally carry the highest interest rates primarily because they are unsecured loans—i.e., not secured by actual physical assets. Even though defaulting on a credit card loan will damage one’s credit, there is no collateral that will be seized if payments are not made. Therefore, higher historical delinquency and charge-off rates make credit card loans more expensive for lenders, as they offset those costs through higher interest rates passed on to consumers. These factors, along with the short-term and variable nature of revolving credit card loans, drive this interest rate differential compared to longer-term mortgage and auto loans, which feature fixed payments and are secured by tangible assets.

While both new automobile and mortgage loans can involve borrowers missing payments and going into default, the repossession or foreclosure of the loan collateral helps mitigate the related losses.

Another factor that tends to keep secured loan interest rates lower involves securitization, which entails lenders packaging and selling bundles of auto and mortgage loans to investors. This securitization of loans transfers the risk liability from lenders to institutional and sometimes individual investors. Credit card receivables (outstanding balances held by account holders) are also sometimes securitized by issuers but generally to a much lesser extent compared to mortgage and new car loans.

Another factor reducing the risk and cost of mortgage loans is the influence of federally backed mortgage loans offered through the government-sponsored enterprises of Fannie Mae and Freddie Mac. Neither organization originates mortgage loans directly, but both purchase and guarantee mortgages from originating lenders in the secondary mortgage market to provide access to qualifying low- and medium-income Americans to promote homeownership.

Those who suffer most from the highest-cost form of credit make only minimum payments on credit cards or don’t pay their balances in full. These debtors can find themselves in never-ending high-interest credit card debt cycles—especially if they need to make monthly payments on other debt obligations (despite their lower interest rates) like their mortgage or auto loan.

Frequently Asked Questions (FAQs)

What role does the Federal Reserve play?

The Federal Reserve doesn’t set your interest rates directly but does set the federal funds rate. Typically, when the federal funds rate is low, interest rates on mortgages and other loans are lower, and when either the rate is high or the market anticipates that the Fed will raise the rates, interest rates climb. In August 2023, the Fed raised rates to their highest level since 2001, and they've remained at that level for a number of meetings since then.

Does my credit score impact my interest rate?

Yes, your credit score is an important part of your borrower profile, which sums up your creditworthiness. The higher your score, the lower your interest rate because the lender views you as less likely to default. The lower your score, the more likely you are to pay higher interest rates, and low scores may require you to seek out a lender that specializes in high-risk borrowers.

How do interest rates affect my ability to buy a home or car?

When interest rates rise, your monthly payment increases and the total amount that you can put to principal decreases, as you’ll be paying more in interest. You can see how this plays out in your particular situation by using our mortgage calculator or our auto loan calculator. As rates rise, your monthly payment becomes less affordable and you eventually may not be approved for a mortgage on the same home that you could have if interest rates were lower.

The Bottom Line

While interest rates on mortgages and auto loans are climbing, they are still historically low when considering data from the last 51 years. Credit card interest rates have remained dramatically higher over time relative to other loan types, largely due to the unsecured and transactional nature of that type of revolving loan product.

Do you have a news tip for Investopedia reporters? Please email us at tips@investopedia.com Article Sources Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

-

Freddie Mac. “30-Year Fixed-Rate Mortgages Since 1971.”

-

Board of Governors of the Federal Reserve System. “Consumer Credit – G.19: Terms of Credit at Commercial Banks and Finance Companies.”

-

Board of Governors of the Federal Reserve System. “Consumer Credit – G.19: Current Release.”

-

Federal Reserve Bank of St. Louis, FRED Economic Data. "Finance Rate on Consumer Installment Loans at Commercial Banks, New Autos 48 Month Loan."

-

Experian. "State of the Automotive Finance Market Q1 2024."

-

myFICO. "The Changing Score."

-

Consumer Financial Protection Bureau. "Examining the Factors Driving High Credit Card Interest Rates."

-

Board of Governors of the Federal Reserve System. "Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks: Charge-Off Rates."

-

Federal Deposit Insurance Corporation. "Consumer Assistance Topics: Loans."

-

Office of the Comptroller of the Currency. "Asset Securitization: Comptroller’s Handbook," Pages 2-3.

-

U.S. Department of Housing and Urban Development. "Fannie Mae and Freddie Mac: Past, Present, and Future," Pages 231-234.

-

National Credit Union Administration. "Paying Off Credit Cards," Select "Real World Examples."

-

Federal Reserve Bank of St. Louis. "Federal Funds Effective Rate."

-

Board of Governors of the Federal Reserve System. "Policy Tools: Open Market Operations."

-

Federal Deposit Insurance Corporation. "FDIC Consumer News: Credit Reports and Credit Scores."

-

Consumer Financial Protection Bureau. "How Does Paying Down a Mortgage Work?"

-

Consumer Financial Protection Bureau. "Understand Loan Options."

Open a New Bank Account Advertiser Disclosure × The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.